Conversation design case study

Running a business is expensive, so owners need to make every penny count. For many, that means taking advantage of their bank’s interest rates by keeping as much as possible in their high-yield accounts. At least, until the bills come due and you have to manually move your cash around…

But what if there was a better way? What if AI could recommend a fund allocation that could maximize yield, but ALSO manage all the transfers automatically? You’d be earning money without ever having to do anything.

This is the idea that led my hackathon team to create an award-winning AI chatbot concept.

The problem

In the summer of 2024, Brex launched an all new structure for its banking products. Previously, customers could earn interest and spend freely with a single “banking” account. But due to Brex’s growth and evolving regulations, banking was divided into 3 accounts: Checking (for spending), Treasury (for earning), and Vault (for saving).

User problem

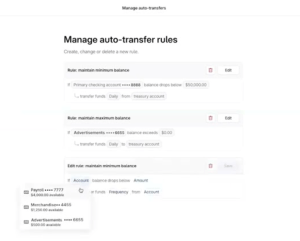

While an auto-transfer tool had been in place for years, it had suddenly become critical for customers to maintain optimal fund allocation.

Unfortunately, the auto-transfer experience also left something to be desired.

It had an unusual Mad Libs-style, fill-in-the-blanks structure that customers found confusing. “If [blank] balance exceeds [blank] transfer funds [blank] to [blank]” isn’t exactly the most intuitive or human way to think about bank transfers.

Business problem

Not only were users having difficulty with auto-transfers, but this was also contributing to missed opportunities for Brex.

Keeping as much money in the treasury account is mutually beneficial for the user and Brex. Not only do customers gain yield that would otherwise be lost, but treasury accounts drive more revenue than checking or vault. So making this process easier is a win-win!

As part of the banking team, I had already simplified the language and cross-linked the tool in different touch points to make it more findable. But without many engineering resources available to our team, there wasn’t much else we could do.

Until the hackathon.

The hackathon

Brex’s annual hackathon presented the perfect opportunity to solve this problem, even though it wasn’t on the banking roadmap. The hackathon’s theme was also about exploring AI solutions.

That’s when my design partner in the banking team and I put our heads together: what if AI could solve all the problems we were seeing with auto-transfers? What would that look like? We gathered a few engineers to help, then got to work.

The solution

From conversations with customers, I’d already learned that:

- they found auto-transfer setup confusing and overwhelming

- with frequent bills and transfers, it wasn’t always clear or straightforward what a good minimum or maximum balance looked like for their business

- a lot of them didn’t even know this feature existed because it was buried layers deep in the product

After this brief analysis, it became clear that the root of the auto-transfer problem was education and visibility.

| Education | Visibility | |

| Setup confusion | Structure is unintuitive and requires guidance | Complexity adds mental load and hinders learning |

| Balance optimization | No resource on how to calculate | – |

| Auto-transfer awareness | – | Buried in settings and only recently x-linked with main transfer flow |

This meant our AI solution had to both make auto-transfer features more visible, and provide educational content on how they work.

We quickly made the decision that an AI chatbot format would best meet both these needs. An LLM-based chatbot:

- provides an additional surfacing point that can proactively open or appear for the right customer at the right time

- allows for a more humanlike dialogue where complex info can be conveyed and a customer can make live changes

Prototype

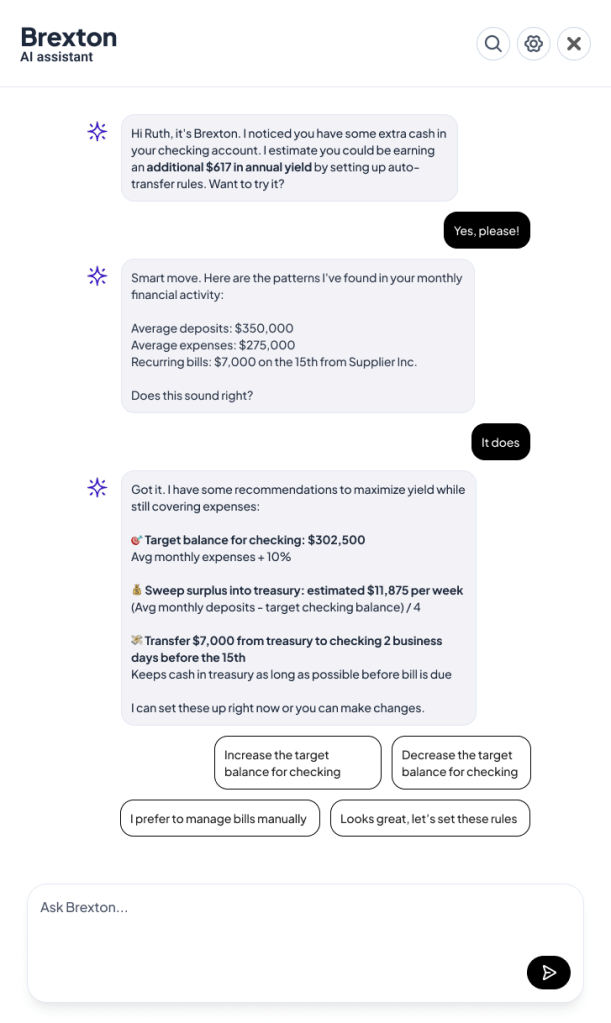

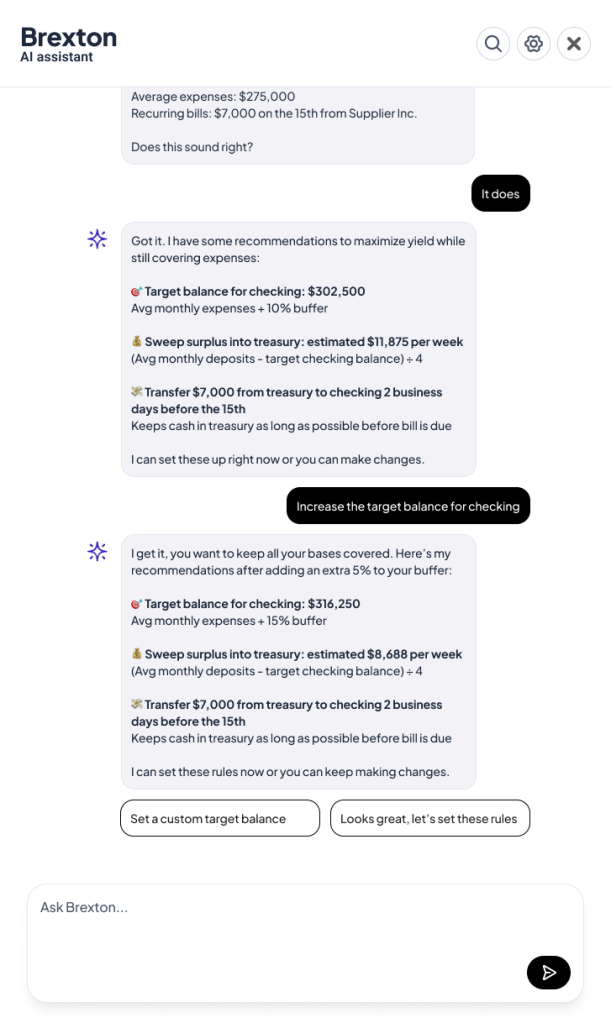

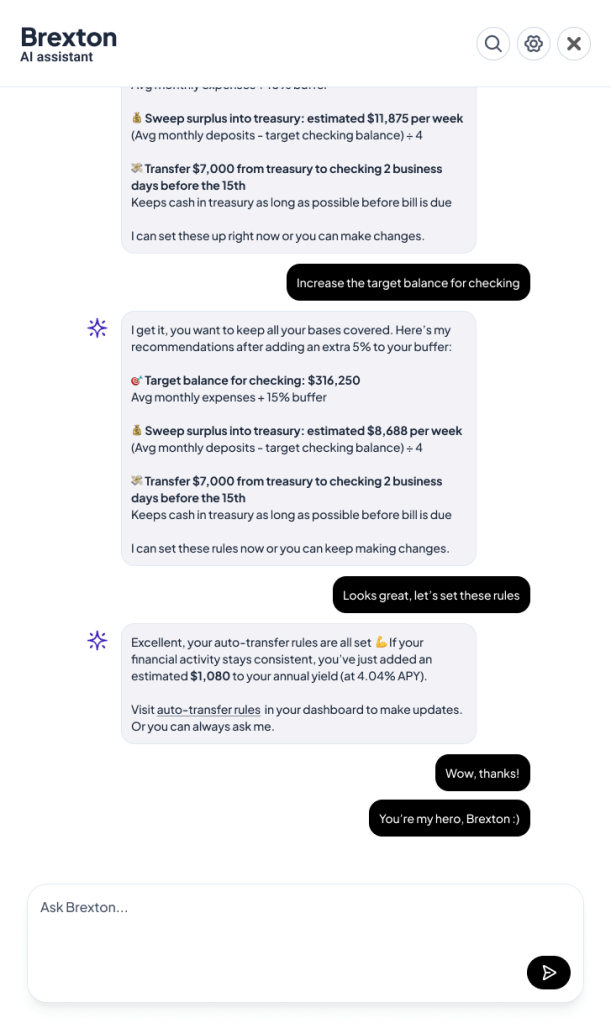

Take a look at the chatbot prototype by moving through the images below. Please note: all designs in this case study are recreations that I made alone and vary from the official designs. This is to avoid using any unreleased Brex property or assets.

Conversation flow diagram

The prototype only shows one example of how the conversation could go. But with an interactive chatbot, the possibilities are endless. But I also made this conversation flow diagram to map out all likely or foreseeable outcomes and how Brexton should react to them.

Conversational design

With only 3 days to product a prototype, there would be a lot for me to tackle as a content designer, now conversation designer.

To lead in this new frontier, I developed a conversational design strategy:

- Chatbot identity for differentiation from other product content and a more human experience

- Transparency to clarify how recommendations are calculated and drive trust and confidence in Brex

- Helpfulness to ensure every message has a job and adds value

- Response options that reduce the user’s mental load

Naming and identity

The first content challenge surfaced quickly: how do we refer to this chatbot and differentiate it from other identities in the Brex ecosystem?

Grammar and pronouns

There are times when product content must refer to the user, the product, or the company directly. And like most companies, Brex uses a combination of the 1st person plural and 3rd person singular.

In the example below, both “Brex” and “we” refer to the same identity.

Brex uses Finicity, Plaid, or Teller to securely and seamlessly connect to your bank accounts so we can view account transactions and balances.

Content from Brex’s help centre, bolding added to highlight grammar choices

On the other hand, it’s become an industry standard for AI/LLM tools to use only 1st person singular to self-refer. This makes the tool feel more human and conversational, like a real person.

Using “I” is a design choice for smoother, more human-like conversation, not a claim that I’m a person.

Quote from ChatGPT on its use of pronouns

I am designed for conversational design and optimal user experience. By speaking in the first person, I aim to mimic the natural flow of human dialogue.

Quote from Gemini on its use of pronouns

This may be obvious to some, but this was an all-new element of content design for Brex. After discussing with my hackathon team and the wider content/brand team, I created quick alignment that first person was the way to go.

But since Brex would still be using we/us in the rest of the product, I decided it would be best to give AI tools a distinct identity from the overarching Brex brand.

Naming

That’s when I decided to name it. Many popular LLMs and AI assistants have been given a human-like name, like Claude and Alexa. Adding a name like this not only gives the chatbot further distinction from other Brex surfaces, but it also adds a little more humanity to the experience.

After a quick vote, the team aligned on a name, and Brexton, the AI fund allocator, was born.

I’m still bummed that Brextina was not chosen…

Voice

Another interesting challenge was adjusting Brexton’s voice. Content folks from both product and marketing had recently come together to revamp Brex’s brand voice, but should Brexton’s be identical?

If we want Brexton to feel like its own personality, it should sound a little different. On the other hand, it shouldn’t sound too different. Transitioning from Brex to Brexton should feel like walking into a different room, not a different building.

For this, I adjusted Brex’s usual, gritty, sharp voice and humanized it. I added soft encouragements like “Smart move” without exclamations (!) or cutesy emojis that can make the voice feel too chipper or casual for Brex.

Transparent calculations and step-by-step guidance

It’s not a big surprise that the existing auto-transfer tool struggled to inspire confidence. With its Mad Libs-style logic, customers were never entirely sure when, how, and why money was moving. Some customers who had tried the tool abandoned it after the rules they built did not work as expected.

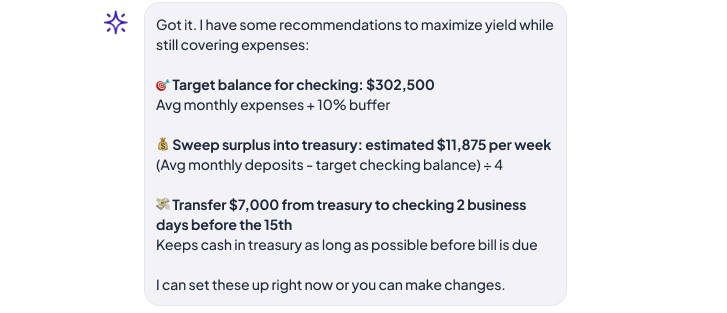

The AI chatbot let us flip that dynamic. Instead of asking customers to guess their way through rules, Brexton breaks the entire recommendation down into clear, digestible steps and light math that lets you follow along:

- Average monthly deposit

- Average monthly spend

- Recurring bills and other patterns

- Recommended balance and how it’s calculated

- The exact day(s) transfers move and what triggers them

By walking the user through each part of the calculation, the bot removes the mystery. Customers can see exactly where the numbers come from, why they make sense, and how they’ll keep the business covered without sacrificing yield.

This transparency turns a previously confusing setup into something clear and easy to follow, inspiring confidence that their money will move in predictable ways.

Helpful chat bubbles that always add value

Because fund allocation is already a cognitively heavy topic, it’s critical that each and every message has a clear purpose. Each one should be bringing the user closer to that end goal, and not distract or confuse.

To ensure clarity and momentum, I designed each chat bubble to do a very specific job. A message must do at least one of the following:

- communicate context, explanation, or a value prop

- let the user adjust, pivot, or proceed

- provide recommendations or adjustments

- confirm completion of the task

Every message becomes a small, purposeful stepping stone that helps the customer confidently progress toward the right fund allocation. This way we can avoid conversational fluff, restating redundant info, or branching out into other topics.

Pre-selected responses to for easier communication

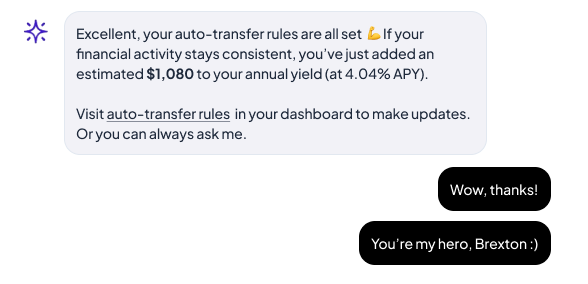

A big lesson I’ve learned in designing LLM-powered interfaces is ensuring users know what options they have. How can we be sure customers would intuitively realize they can adjust their target balance if that possibility is not explicitly surfaced?

That’s why I added pre-selected response chips at certain “pivot points”, where the user has multiple options to consider. These responses:

- highlight the most common and relevant actions at each moment

- reveal options the user may not have known were available

- prevent users from feeling stuck with a recommendation they disagree with

- reduce the need for freeform typing, keeping the chat faster and more structured

When Brexton presents a recommendation, chips like “Increase the target balance” or “Set a custom target balance” make it clear that YOU are in control. Without these prompts, some users might hesitate to proceed with a number that feels off.

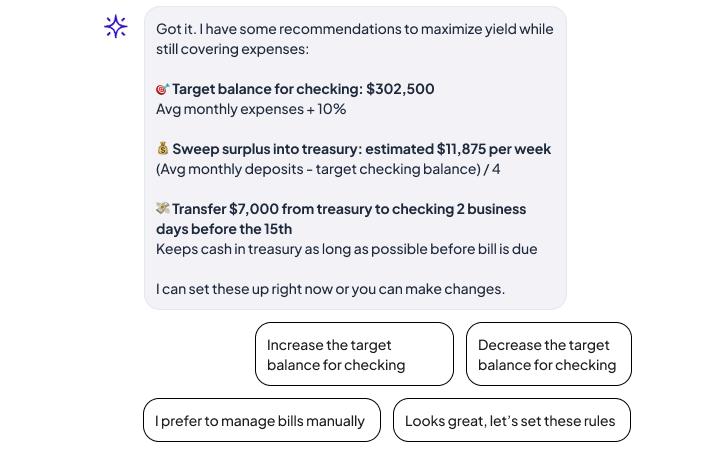

The results

Since this was a hackathon project, there aren’t any real-world results to share (yet). But it did make a big splash.

The fund allocation chatbot won a top hackathon prize! Every team member (including myself) was rewarded with our own pair of Meta Ray-ban smart glasses. The project was also taken by senior leadership to discuss with Brex’s AWS contacts to see how viable it would be to implement.

What I would do next

Although this was a 3-day hackathon project, I thought about what would be needed to evolve the prototype into a real, launchable feature. If this were moving toward launch, my next steps would be:

1. Validate user mental models

We’d assumed a chatbot format was the best strategy for understandability and for the time constraints of the project. But if we had more time, could we find a better solution? I’d like to create a fully interactive prototype to let customers play with it and see what they say.

- Is it helpful or overwhelming?

- Do the numbers make sense and give better understanding?

- Do you feel comfortable taking recommendations from Brexton?

- Do you feel this method helps you set auto-transfers faster or slower than before?

- What other measurements do we use? e.g. Increase in auto-transfer rules created? Increase in cash transferred to treasury? Chat flow completion time?

2. Identify constraints

This chatbot was a new world for Brex. We’d never used LLM technology in product so directly. This left a lot of unknowns open that we would need to close to make this viable.

- Are there any legal or compliance issues we’d have to account for in giving financial advice via AI?

- What kind of technical resources would be needed to connect this bot to an LLM? Which one is the best choice to use?

- What’s the strategy if the customer gets Brexton off track? Users could potentially type anything, even topics unrelated to Brex. How should Brexton handle this?

3. Make it scalable

We centred this chatbot around the auto-transfer feature because this is the problem we set out to solve with AI. But a chatbot has so many potential applications for Brex. What about making bill payments? Creating travel itineraries? Or even identifying fraud?

If Brex really wanted to go all-in on an in-product Brexton chatbot, it would become a HUGE, overarching tool. To make it scalable, I’d need to create:

- Comprehensive tone and personality principles

- Reusable conversation patterns

- Guardrails and logic for if conversations go off the wall

Who knows? Perhaps someday soon, you may see Brexton pop up with a helpful recommendation the next time you’re using Brex.

Want to see more?

Check out my other case studies or learn a little more about me.